Passive income has become the dream of millions. I guess it is one of the main driving forces behind most online businesses.

But what is passive income? I mean the type where you can really lay back and count your money while it still keeps coming in…

My goal here is to give you a better understanding of what passive income is, and maybe help you in your journey to build a passive stream for you.

What Is Passive Income?

Passive income is a type of income where you get paid repeatedly, regardless of whether you’ve worked or not in a given time period.

The opposite of passive income is actually active income, which is received for performing a service. Wages, tips, salaries, commissions, and income from businesses in which there is material participation are examples of active income.

Two Main Mistakes With Passive Income

The two main mistakes that I most commonly see when it comes to understanding passive income are the following:

- People want passive income, but they refuse to put in any energy (money or work) even in the beginning.

- If it involves any kind of automation, people happily accept it as passive.

Let’s analyze these a bit deeper so that you can better understand what passive income is.

Every Income Needs Effort

The best way to fool yourself is to believe that there is a possibility of achieving passive income (or any kind of income for that matter) without an initial investment. Never forget the old saying, there ain’t no such thing as free lunch.

In a regular job we usually understand this concept. You need to work 8 hours a day for at least one or two weeks, maybe a month, and only then you get your first salary. And this goes on basically for as long as you want to get paid in that job.

But when it comes to passive income, online income or any income that could be labeled as non-regular, people tend to think that there is a magic wand you just need to find and swish and voilá, money keeps pouring into your account.

Nothing could be further from the truth.

Initial Investment For Passive Income

The most important thing you need to understand and accept is that if you want to build passive income, you need to put in some effort at the beginning. See the inverted S-curve explanation below.

This initial investment does not necessarily need to be monetary though. Of course when it comes to real estate investing or buying stocks, you definitely need hard cash. But a writer is also building passive income when writing a book. This process in itself, writing a book for example, is also a huge investment, but it requires time rather than money.

If you analyze any long lasting, real passive income sources, you’ll realize that some kind of initial investment, generally a substantial one, definitely had been made in the beginning.

Investment For Online Passive Income

An online business specifically built for providing passive income would be another good example.

Everyone is dreaming about this, but only few accept the fact that a lot of work must be done at the beginning. You can start with your money, in this case the content and the website will be created by others. But you can also build online passive income with no monetary investment. Instead of your money, you need to put in your time in that case.

And sorry, no escape from this. If it does not involve sweat in the beginning, it will not worth it in the long term.

The Passive Income Inverted S-Curve

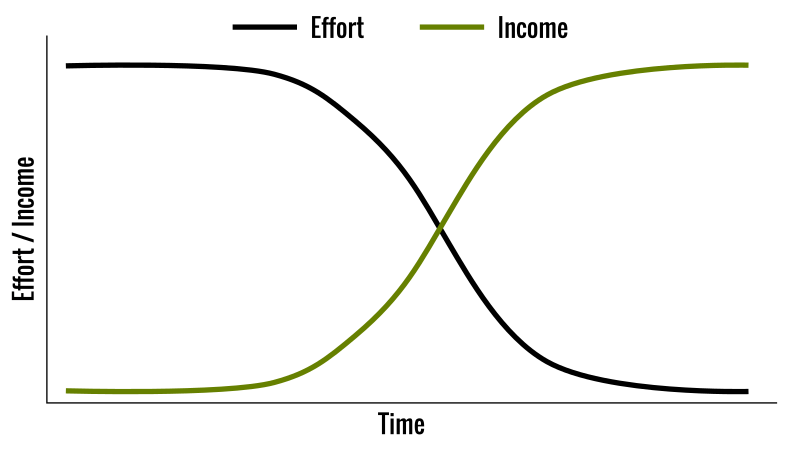

It is easy to visualize this initial effort with what I call the passive income inverted S-curve (see below). It is the representation of the effort (money and work) needed and the income generated on the same chart.

Both have a characteristic “S”-shaped curve, but one is exactly the opposite of the other. You need to put in a lot of energy in the beginning for seemingly no result. Then, as the income keeps growing, you can gradually decrease the effort. If you play this game right, you can reach the desired situation, when almost no effort is required but the income is at max levels regardless.

Please note that this chart only serves visualization purposes. The actual effort needed and the amount of money generated differ greatly from situation to situation.

Automation ≠ Passive

Another misconception I see is that people often think that if a business involves any type of automation, it is subsequently a passive one. And as people easily identify anything online with being automated, soon we can jump to the false conclusion that every online business is basically a passive income generator.

Again, far from the truth.

In fact in order to satisfy the criteria of passive income, an online business have to adhere to these two rules:

- It must generate a large number of website visitors repeatedly without your active work. Search Engine Optimization is a great way to achieve this. Some people also play this game with traffic generated from ads.

- Need to have at least one method of generating substantial income without active work. Automated ad solutions or affiliate programs do exactly this.

These Are Actually Not Passive Income Sources

The following are just a few examples, but most of these I hear mentioned very often as passive opportunities. But in reality these are just some fancy-schmancy names for another job where you sell your time.

I know it is kind of strange to list what is not passive in an article about passive income, but I hope this will help you better analyze any future situation. And reject opportunities that are labeled as passive but in reality are not.

- Multi-level-marketing

- Being a solopreneur

- Any entrepreneurship where your active work is needed

- Making money from your daily activities

- Making money from your hobby (if it requires your active work)

- An e-commerce store

- An online business (requiring your active work)

- Being paid by the hour, no matter how you love what you do

- Consultancy

- etc. — do you have anything in mind that was advertised as passive but turned out to be a job in disguise?

Basically any of the above business opportunities can be developed into a passive income source. But in order to do that, you need to take care of every aspect that requires active collaboration and delegate them, or find an automated solution for that specific task.

4 Most Common Passive Income Sources

Real Estate

Real estate is a classic way of generating passive income. It is also a very safe solution. You’re dealing with tangible items that are difficult to recreate and that will always be needed.

It requires knowledge and a lot of up front money though to participate in the real estate game. I would recommend you start with Grant Cardone’s real estate advise if you’re into this. (The guy is a world famous real estate investor.)

Business shares

Making income as a business owner is another preferred way of generating passive income by savvy investors. The key point is that you must not work actively in that business, but instead having the business work for you.

There are basically two ways of achieving this:

- You buy shares with money, in which case this method is somewhat similar to the real estate game.

- You build a business from scratch and than manage it to be run by other people without the need of your active work.

Believe me, this second solution, as tempting as it sounds, proves to be extremely difficult for most entrepreneurs out there from time to time.

Intellectual property

There are many types of intellectual property. From a personal prospective, mostly patents and copyright are what you might consider here.

Automated websites

Although this sounds Greek for most people, generating passive income from automated websites is a viable option for literally anyone.

To put it simple, you need to build online content that satisfies the two above mentioned rules: 1. Generate a large number of website visitors repeatedly without your active work; 2. Have at least one method of generating substantial income without active work.

14 Passive Income Ideas

Here are 14 of the best passive income ideas anyone should use to start building a more relaxed future. Please note that I only included ideas that I consider real passive income.

- Blog with automated Ads

- Affiliate website

- YouTube channel

- Selling leads (from a website)

- Flipping websites

- Royalty from books

- Royalty from music

- Photo royalties

- Stock portfolio dividends (portfolio income)

- Business investment (if no active work is required)

- Patent dividends

- Real estate rental income

- Peer-to-peer lending

- REITs

Passive Income For Beginners

If You Have No Initial Money To Invest

If you don’t have money to start building your dream future, the one method I would start with (and the one that I actually did use) is building a blog or website with automated ads.

This won’t make you a ton of money, but it is a great way to start your journey with minimal risk involved. Here are some of the benefits of starting a blog for building passive revenue:

- Very easy to start

- No initial investment is required

- You’ll understand how the online world works

- You’ll finally cash in some real passive income – a benefit not to be underrated

For more information, read my article on how to make money blogging. It even goes beyond and lists some active income ideas for bloggers.

Having Some Money To Invest

If you have some money to invest, I would start with real estate. Some of the benefits

- Risk management. Even if the income stream is not working, you can still recover at least some of your investment.

- Real estate is the most tangible asset. In other words, it is easier to see and understand without previous experience than other investments.

Passive Income And Taxes

People always wonder whether they have to pay taxes on their passive income or not. Please note that I’m not a tax consultant and regulations differ greatly by country. But in general, you may consider the following:

- It is after all an income, and you need to pay taxes on every type of income as a general rule.

- The best option is to contact a certified tax consultant. They can help you find the best solution, based on your current situation.

- As a general rule of thumb, passive income can be subject to lower effective tax rates than active or earned income. Click here to read a good article on this subject.

- There are many ways of reducing your tax rate. Again, a good tax consultant will help you with this.